Setting up a subaccount under the current bank account in QB

Summary: This method will create a separate bank register under the existing bank account register, allowing you to track PPP Loan expenses by simply changing the bank account from “Checking” to “PPP Loan subaccount” when spending PPP funds.

Advantages of using this method – it’s easy to see at a glance how much money is left from the PPP Loan funds and you can run a report that will show how the funds have been spent. Additionally, it saves the step of having to set up a new bank account and transfer funds between bank accounts.

Limitations in QuickBooks reporting – Just like opening up a new traditional bank account, a QB report of the “PPP Loan subaccount” bank register will show the monies that came out of this subaccount, but it won’t give you a total of the different type of expenses (payroll, rent,etc.). You will need to use a separate Excel Spreadsheet or ledger to track what the expenses were used for. This will be important since 75% of PPP expenses must be for payroll costs in order to be eligible for PPP Loan forgiveness. Using the Class Tracking feature (see next section) will allow you do that tracking, and can be used with a subaccount.

How to use the "Setting up a New Subacccount" method:

Setting up a new “subaccount” in QB will create an additional bank register under the existing bank account in QB (let’s call that the “Checking” account). Any PPP expenses will be recorded as being paid out of the newly created “PPP Loan subaccount” instead of the “Checking” account. You will continue to write checks, make deposits and reconcile the main account as you normally do but when you are paying for PPP Loan expenses you will select the “PPP Loan subaccount“ instead of the “Checking” account.

All activity in the “PPP Loan subaccount” is included in the Checking account. In other words, when you look at the “Checking” register you will see all activity (including the PPP subaccount) but when you look at the “PPP Loan subaccount” register you will only see PPP expenses. (see illustrations at end of section)

How to set up and handle transactions using this method:

-

Create a new Long Term Liability account called “PPP Loan Payable”

-

Go to Lists at the top menu then Chart of Accounts.

-

Select Account in the bottom left corner then New.

-

Select Other Account Types, Long Term Liability and then Continue.

-

Name the account something like “PPP Loan Payable”. Do not enter an opening balance.

-

** It is recommended to set up the loan as a Liability until it is determined how much of the loan will be forgiven. If some or all of the loan is forgiven you can create an “Other Income” type account called “PPP Loan Forgiveness” and make a Journal Entry to Debit the “PPP Loan Payment” liability account and credit the “PPP Loan Forgiveness” other income account.

-

Set up the new subaccount (bank register) in QB

-

Go to Lists at the top menu then Chart of Accounts.

-

Select Account in the bottom left corner then New.

-

Select Bank then Continue. Name the account something like “PPP Loan subaccount”

-

Select Subaccount and use the drop down box to pick “Checking” Account. Select OK. Do not enter an opening balance.

-

The new account will show up as “Checking: PPP Loan subaccount” since “Checking” is the main account and the “PPP Loan subaccount” is a subaccount under the Checking account.

-

-

Record the Deposit of the PPP Loan funds received

-

Go to Banking at the top menu and then Make Deposits

-

Deposit To = the newly created “Checking: PPP Loan subaccount”

-

Enter the date the funds were deposited

-

Received from = the lender you received the funds from (set up a new vendor if needed)

-

From Account = “PPP Loan Payable”. Enter memo and amount.

-

Class = if you are using Class Tracking for PPP Expenses enter “PPP Loan” as the class.

-

Recording expenses paid out of regular Checking account

-

IMPORTANT: Make sure that the correct bank account is selected when recording expenses

-

PPP Expenses – when PPP expenses are paid use the drop down arrow to change from “Checking” to “Checking:PPP Loan subaccount”. Remember to change it back to “Checking” when paying non PPP expenses.

-

Operating Expenses - for your regular non-PPP expenses (or deposits) make sure Checking is selected as the bank account and not the “Checking:PPP Loan subaccount”.

-

-

-

Recording payroll expenses

-

Payroll can be recorded in different ways depending on whether it is processed through QuickBooks Payroll or a 3rd party payroll processor. See the section on “Recording Payroll” on page 8 for details.

-

No matter how payroll is recorded it’s important to remember that the amounts drafted from the bank account are not always an accurate reflection of those payroll costs eligible for PPP Loan forgiveness (ie employer FICA and FUTA are not eligible but SUTA is). In order to keep the PPP subaccount register accurate you will need to move those ineligible expenses from the “Checking:PPP Loan subaccount” to the” Checking” account in QB. You can do this with the Transfer funds option (Banking from the top menu then Transfer Funds).

-

REPORTS - there are 2 ways to run a bank register. The first report will give you the information but it is not possible to modify the report or export it to Excel. So, if you need further information you will need to print report #2.

Report 1 – go to Bank at the top menu, Use Register and the select the “Checking:PPP Loan subaccount” bank account. Click on the Print button in the top left corner, enter the dates and OK ( “Print split details” will show you additional information). This report will print the entire bank register but it cannot be modified so if you need additional information you will need to run Report 2.

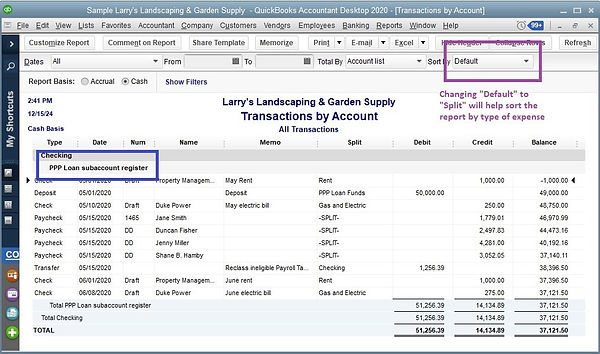

Report 2 – go to Reports at the top menu, Company & Financial then Balance Sheet. You will see the “Checking account:PPP Loan subaccount” with a balance to the right. Doubleclick on that balance amount to bring up a Transactions by Account report. You can customize this report to suit your needs (add or remove columns, sort by type of expenses and more). Here’s a sample report after customization:

To read about other available methods

Want a PDF Copy?

Sometimes it's just easier to download or print out a file than have to view it on a computer screen so we are now offering the option of purchasing a PDF file for download. This 17 page document includes all of the PPP Loan Tracking information on this website, including screen snapshots and detailed instructions. To purchase: